One of the important challenges we face as parents ourselves is how to teach our kids about money. And not just the difference between a dime and a nickel–yes, the nickel is bigger but it’s not worth more. Boy, that’s a hard one with our kids!

One of the important challenges we face as parents ourselves is how to teach our kids about money. And not just the difference between a dime and a nickel–yes, the nickel is bigger but it’s not worth more. Boy, that’s a hard one with our kids!

We’ve learned is that every parent has different values when it comes to money and kids, so of course you have to do what’s best for your own family.

That’s why we’re so happy to once again be teaming up with BMO Harris Bank, which is committed to helping families make good financial decisions. And so are we! So we put together 5 simple tips pretty much universally recommended to help teach kids about finances.

1. Start early, and keep it simple

1. Start early, and keep it simple

Whether it’s teaching your toddler how to drop coins into a piggy bank or giving your preschooler a small allowance, it’s never to young to start teaching your kids about money. It’s okay to tell a child that money is not unlimited, or to explain budgeting in basic terms so they know why you don’t say “yes” to every single item at every single gift shop at the theme park.

We’ve explained to our own children, “We need to save our money to pay for the things we need, and after that, we only have a certain amount leftover for the thing we want.” Even our preschoolers understand the basic premise of limited funds.

Besides, the earlier they understand that you care about money management, the more likely they are to care about it. That’s something you’ll especially appreciate when they’re off at college with a first credit card. (Eep!)

2. Use the “Save, Spend, Share” system

You don’t necessarily need a complicated system or in-depth money program to educate your children about the value of a dollar. We love the basic “Save, Spend, Share” concept — where kids learn to put aside money for saving, for buying things they want, and for giving, perhaps to a family cause or charity that hey have an interest in themselves. There are some piggy banks with three compartments made for that very thing, or you can create your own by labeling three different boxes or piggy banks differently.

The great part about this system is the empowerment it gives children. When you allow your child to decide for themselves how much to save, and what they might want to save for, you’ll find they get very excited by the concept.

3. Consider whether you link allowance to chores

If you feel as though your kids are ready to earn an allowance, there are a few different concepts that parents use.

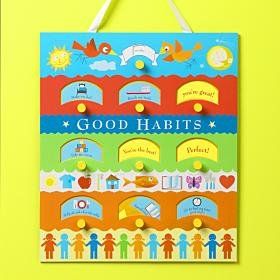

One option is to create a daily responsibility list based on the child’s age age, that earns him a weekly “commission.” You can track chores with either a visual chore chart or a handy chore app.

However a lot of financial experts suggest that household chores are a mandatory part of being a member of the household, and that allowance is not a payment for making beds or clearing dishes. (Though you could dock allowance if responsibilities aren’t met each week.)

However a lot of financial experts suggest that household chores are a mandatory part of being a member of the household, and that allowance is not a payment for making beds or clearing dishes. (Though you could dock allowance if responsibilities aren’t met each week.)

Still other parents offer “bonuses” for additional chores, or special occasions like around holiday time. It’s okay to play around until you figure out the one that works best for your family. It might take some time for everyone to get used to a system before the magic happens.

4. Be consistent

When you do settle on a money plan for your family, it’s important to stick with it. We’ve found that if we forget a day, our kids will be the ones to remind us, particularly if they’re saving up for something big. But the allowance system is only good as the person implementing it. If you can’t seem keep things consistent, it’s time to change systems.

5. Be a financial role model

Above all, the best way to teach your kids about money is to be the kind of money manager that they can follow. Take them with you to the grocery store so they can understand how much things cost–and how awesome it can feel to use a coupon. Or show them the thank you note you receive when you donated to a charity, and show them how the money will be used Put your money where your mouth is (pun intended) and make sure your own financial choices are what you’d want your own kids to make as well.

Our huge thanks to BMO Harris Bank for underwriting this post. We love any excuse to provide helpful tips to our readers.

Great ideas.

We’ve also posted some ideas on our blog – https://bankaroo.com/2012/03/13/7-ways-to-get-your-kids-to-value-money/