It’s probably no surprise that I have a penchant for shopping, but for about the last six months in particular, I’ve actually been trying to cut back, seeing as how we’ve now got braces, and summer camp, and hopefully a family vacation to save for.

I’m not an overspender, but I admit I do make the extra trip to Starbucks for a coffee when I could easily just make a cup at home (there’s value in getting out of the house when you work at home a lot); and I do have a hard time passing up a hot pair of platform sandals on sale — even when I might have a pair just like them at home.

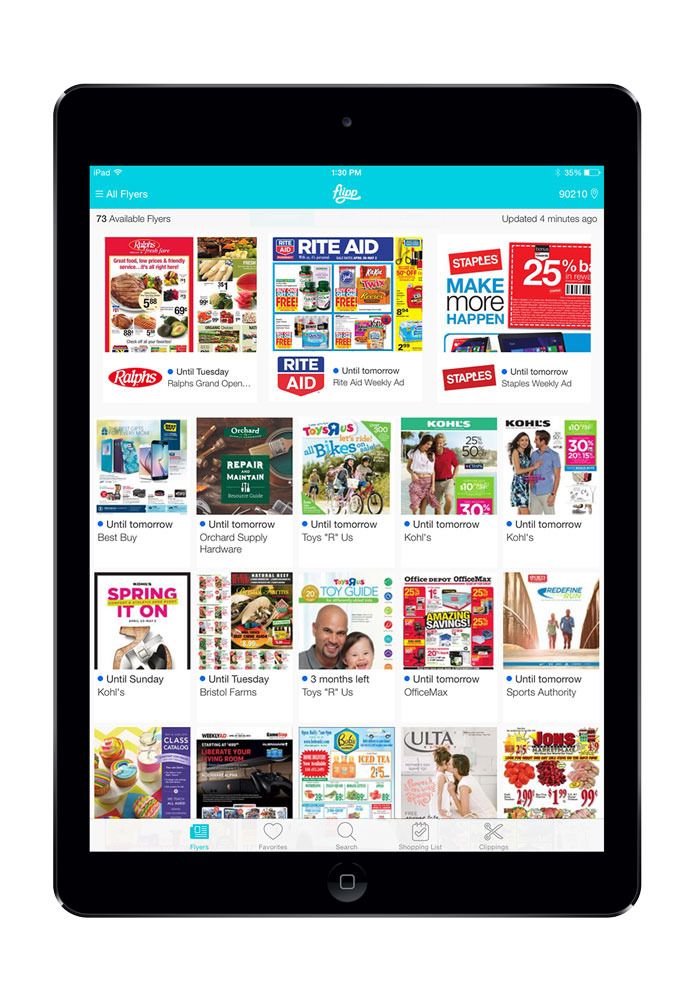

So how perfect for me that we’re welcoming back our sponsor Flipp, a fantastic free app for iOS and Android that’s one great way to save money — and time — on your weekly shopping. The app lets you easily search through hundreds of circulars from your favorites stores right on your smartphone or tablet, and you don’t have to actually do anything special to get the deals either; you just find them, and shop.

Aside from using helpful apps like Flipp, here are 7 things I’m doing right now to cut my spending. Some are easy, some involve a bit of a perception shift. But they’ve all helped me, and I really hope they’ll help you and your family too.

1. Look at your monthly statements. Always!

Seems basic, right? Well since I tend to use my credit card for most of my purchases and then pay the bill off at the end of the month, I did not always a very good sense of what I was actually buying. It’s incredibly easy to swipe and think later, not even realizing that certain expenses — like eating out, or those venti coffees — do add up.

Just take a look at your monthly bills by category, and above all, comb through your year-end statement by category for a great birds-eye view of your spending habits. (American Express cards are fantastic that way as are others that have excellent statements you can sort by product category.) I cannot tell you how helpful it is to see in black and white that the amount you’re spending on take-out or cabs or lattes could pay for a summer camp deposit. Extremely eye-opening.

2. Don’t set a budget without goals

Everyone always talks about budgeting. I am going to admit right now that setting a budget is a huge challenge for me because my income is inconsistent from month to month. Even a bookkeeper has told me I can’t do any sort of “envelope” system because of the way my paychecks work. However if you do have a consistent income and you want to save money, setting a budget and sticking to it is super important — but equally important is taking the time to set goals.

Give yourself a really specific goal to achieve so you can see why it’s worth sticking to it in the long run. Is it a big Disney vacation for your family? Is it that hot designer bag you’ve been coveting? Is it a certain amount deposited in a 529 savings plan for college at the end of each year?

For me, a budget is like exercising everyday; you can do it, but without a goal in mind it can be harder to stick with it, and that’s not advice you hear all the time.

3. Pay yourself first

Liz talked to me about idea of “paying myself” first with each paycheck, which is an idea her father instilled in her. I admit at first it sounded ridiculous, because with many darn bills and expenses, how can I set an amount to set aside for savings or emergencies? Then I realized that it doesn’t necessarily need to be a lot of money. Dedicate $10 or $25 or $100 or whatever works, which is automatically transferred from your checking to savings account the same day each month, so you never have to think about it. (Kind of like those automatic medical or 401(k) deductions from your paycheck that you don’t really miss.)

Or hey, just start by tossing your change in a jar. Or whenever you discover a single dollar bill in your wallet, put it aside in an envelope. You will be surprised how quickly that money adds up!

4. Never shop without a list. Not just groceries, either.

I tend to keep my shopping list in my head, especially when it comes to groceries (I know, I know!), and while I’m pretty good at sticking to it, I admit that on too many occasions, I bought something that I already have plenty of in my refrigerator already. Hello, six bags of frozen edamame.

This isn’t just for the supermarket; are there things you need for home improvement? For a construction project? Birthday gifts? It really does pay to create those shopping lists before you leave the house, whether you’re jotting it down in your smartphone’s notes app, or a dedicated grocery list app.

In fact Flipp just launched a smart new shopping list feature that allows you to input the items you need and then finds the deals for them. It keeps me from buying something just because it’s on sale (oh I’m so guilty of that) helps ensure I’m getting the best prices on the stuff I really need.

5. Label some purchases as treats or rewards

Like many suburban families, we live in the car during the week, and so it’s just quicker and easier for me to stop at a Wawa (my favorite local convenience store), Panera, or Starbucks to pick up a coffee or a snack or sandwich for my kids. I wanted to cut back on these things, and it made it easier when I started to frame it up differently.

Instead of thinking of an $8 sandwich being a part of our everyday existence, I started to define those purchases as treats or rewards. Should I be giving myself a reward every single day? Eh, probably not. Even though on some days it feels like I should.

The new perspective really helped me make incredibly money-saving changes, and now my kids see these things differently too. We’ve all become more grateful for the times we do go out to eat, grab an ice cream, or stop for a sandwich on the road.

6. Cut back on impulse purchases with the 10 minute test

I’m not necessarily an impulse buyer, but if I see something I like at a great price, it can be hard to talk me out of it — even if there’s a strong chance that I don’t need it.Yes, the shoes are cute and they are a great price, but I kind of do have enough summer sandals.

So lately, I’ve really been taking a few extra minutes to decide whether this item is something that I (or my kids) absolutely need. I walk around the store with it. I stand there and think about where it fits in my closet or my home. Only after ten minutes or more do I decide.

Surprisingly, it most often ends up with me putting the item back on the shelf.

It’s like that old trick about stepping back from a purchase to gain clarity; if you’re still yearning for it the next day, then go back for it. However the majority of the time, you’ll probably have forgotten completely about it.

7. Buy in bulk, but not for the reasons you think.

Sure, it helps to have your pantry stocked with bulk snacks so you can save when you pack kids’ lunches in your own reusable containers. And to reap the savings when you buy a zillion-pack of cotton swabs. But think of it another way: When I plan ahead and have all the essentials I need on hand, it actually keeps me out of stores.

Turns out this is the very best tip that’s helped me cut back on spending.

In other words, if I’ve got enough toilet paper, kid shampoo, paper towels, laundry detergent — then I’m not compelled to make a dedicated trip to a store just for that one thing, which never ends up being just that one thing. (The chocolates were on sale! That new organic juice blend looked awesome! You know what I mean.)

By thinking ahead and keeping the essentials stocked, I have found that I have really cut down on the opportunity to spend money, and therefore actually not spending that money. Makes sense, right?

Thanks to our sponsor Flipp for helping busy parents (and hey, non-parents) save time and money, especially now that they’ve added their new shopping list feature.