As an adoptive mom, I’m committed to fighting against Trump’s new tax bill that, among other things, eliminates the essential adoption tax credit for families. Here’s why.

Adoption is expensive. Like, crazy expensive.

While it’s 100% worth it without a question, by the time my husband and I had adopted our daughter from Korea last year, our fees were over $40,000. And that wasn’t cash we just had sitting around. We fundraised, we took on extra work, we applied for grants because it’s something we were really committed to doing.

However a large part of our budgeting was based on the knowledge that the adoption tax credit was in place, and that it would — in a sense — refund $13,570 of the government and agency fees we paid, which in turn would help us pay back the loans that covered the remainder of our fees.

That tax credit is a beautiful thing for families, and for the thousands of families who adopt children in the US each year — 40% of them from the US foster system alone.

But now, it’s looking like that credit might go away. And you may not realize, but that has major implication for the whole country and not just parents who adopt.

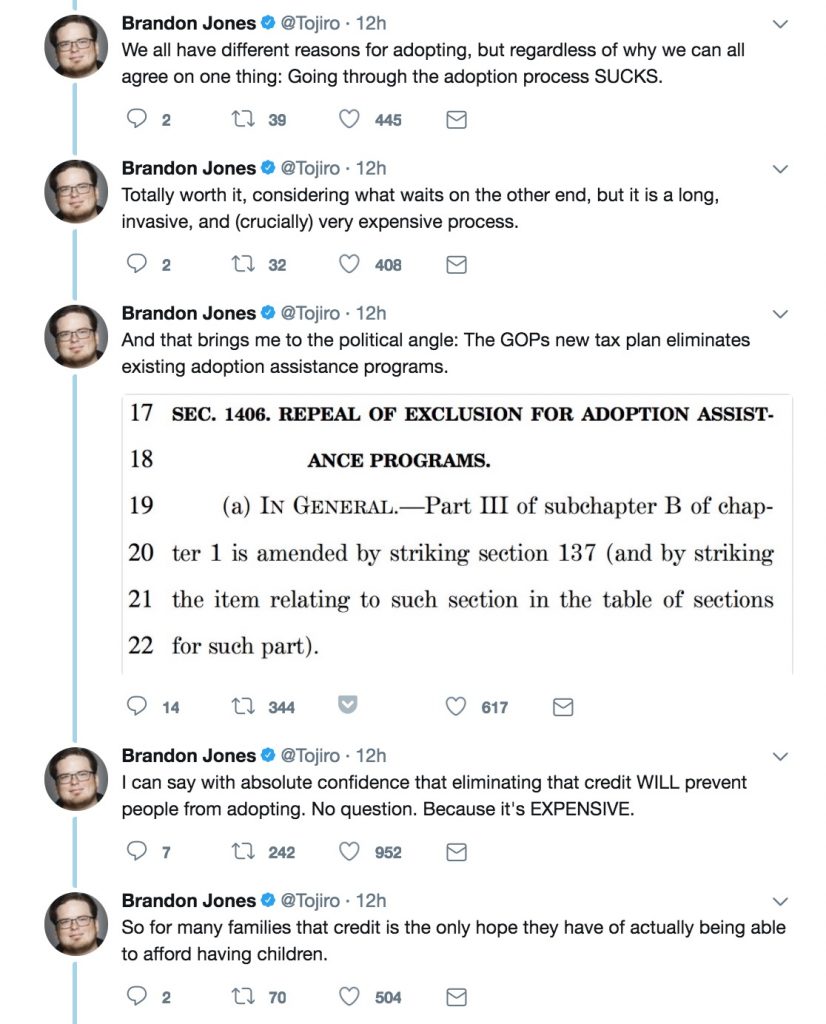

Brandon Jones (@Tojiro) a California web developer and adoptive parent, tweeted a powerful thread last night about the proposed adoption credit cut that’s absolutely worth reading.

This is just a small part of it:

Related: What to say when you call your representatives (and why it’s not scary)

He goes on to explain the adoption tax credit in a clear, informative, honest way, and articulating just how cutting this adoption tax credit means fewer people will adopt. Which is my fear as well.

Related: Thinking about adopting? Here’s how to get started, from a parent who’s been there

Fewer kids adopted means more kids staying in foster care. And the emotional impact of that aside, from a purely financial standpoint, it doesn’t even make good financial sense.

Without getting into too much detail, the government pays $6,000 a year in annual administrative fees per foster child. That’s far more than the average $4,820 per child (per the Tax Policy Center) credit that families receive. In other words, it will cost taxpayers far more over time to support more children in the foster system.

The newest addition to our family

The newest addition to our family

A loss of the tax credit also means that families will have less money to devote to their children’s lives and well-being

Most people I know have used the credit to pay off their adoption loans or to cover future medical expenses. We’re not exactly taking fancy vacations with it! Adoptive mom and entrepreneur Anna Caudill, founder of PALS, has described how she used her adoption tax credit to pay for her children’s medical expenses, including physical therapy, antibiotics, and frequent travel to the Shriner’s hospital in Philadelphia.

Without that money, she couldn’t have afforded the treatments her son needed.

Without that money, her son wouldn’t be walking today.

That is a huge deal.

Don’t we all want as many children as possible to grow up to be productive, successful contributing members of society?

One of my favorite adoptive parents with her kids

One of my favorite adoptive parents with her kids

Elimination of the the adoption tax credit would be especially devastating to families who adopt kids with special needs — and that’s a full 88% of domestic adoptions.

These parents have middle-class incomes, and beyond the overwhelming expense of adopting in the first place, they also have the continuing expenses for therapies, medical equipment and treatment, pharmacy bills, accessibility renovations and more after their kids come home.

One friend’s wheelchair-bound child racked up an unexpected $100,000 hospital bill after an emergency week-long stay. Another friend was told her kids’ special needs would never require surgery; but they’ve turned out to require needed multiple surgeries per year.

Still another friend spends more than $800 per month, after insurance, on her daughter’s prescriptions alone.

Don’t get me wrong: we are not complaining. These parents, like me, are adopting children because we want to. We are absolutely willing to take on all the responsibilities that entails, including the financial ones.

But this longstanding adoption tax credit has provided really valuable relief for those of us who aren’t trust-funders, and who still feel that adding to our families through adoption is something we are meant to do.

A tax change that keeps parents from adopting children in need of families isn’t just wrong, it’s cruel.

If you want to call to your representative about the adoption tax credit, call the congressional switchboard at 202-224-3121. It will take you 3 minutes.

Top photo: Thiago Cerqueira via Unsplash

Losing this tax credit would be devastating for these families and even more devastating for these children who need homes! There is an organization called Helpusadopt.org that gives adoption grants to families struggling with the cost of adoption—I imagine that if this tax credit gets cut even more families will need their help!

Thanks for sharing this, Becky!