by Cool Mom Team | Books for Kids, Tips + Tricks

With April being Financial Literacy Month, it’s a great opportunity to share an age-by-age guide to teaching kids about money. After all, it’s one of the most important things we need to teach our kids — it impacts every one of us for our entire...

by Liz Gumbinner | Living

One of the things that I’ve started doing over the past few years is signing up for practical subscriptions that get delivered to me every few months or so. It’s saving me time, saving me money (a lot!), and saving me a whole lot of hassle when I’m...

by Cool Mom Team | Tips + Tricks

With my oldest heading off to college this fall, I’ve been thinking about all the things kids should know before leaving home. And it’s a lot. In fact I’ve found myself in a sort of panic mode wondering whether she knows some basics to help her...

by Cool Mom Team | Tips + Tricks

Our team at Cool Mom Picks jokes that we have a lot of children among us, but the truth is, we have quite a few divorces and separations among us too. That means we’ve had a lot of experience trying to achieve healthy co-parenting, having navigated some...

by Liz Gumbinner | Tips + Tricks, Living

If you have a few minutes to spare, you can literally save money. And that sounds like a good way to start the new year, right? Of course I’m sure a lot of us have some version of “get my finances in order” on our list of New Year’s...

by Kristen Chase | Tips + Tricks

We’re always searching for ways to save money where we can, but with grocery and gas prices on the rise, it’s definitely on our minds. Thankfully, there are simple changes you can make right now that can save you money. And no, we’re not going to tell you to start a...

by Liz Gumbinner | Doing Good, Tips + Tricks

Over the past few years, I’ve committed to my favorite charities and causes by changing my donations from end-of-year or once-in-a-while to an automated recurring monthly contribution. I’ve learned that it’s a really solid, easy way to help...

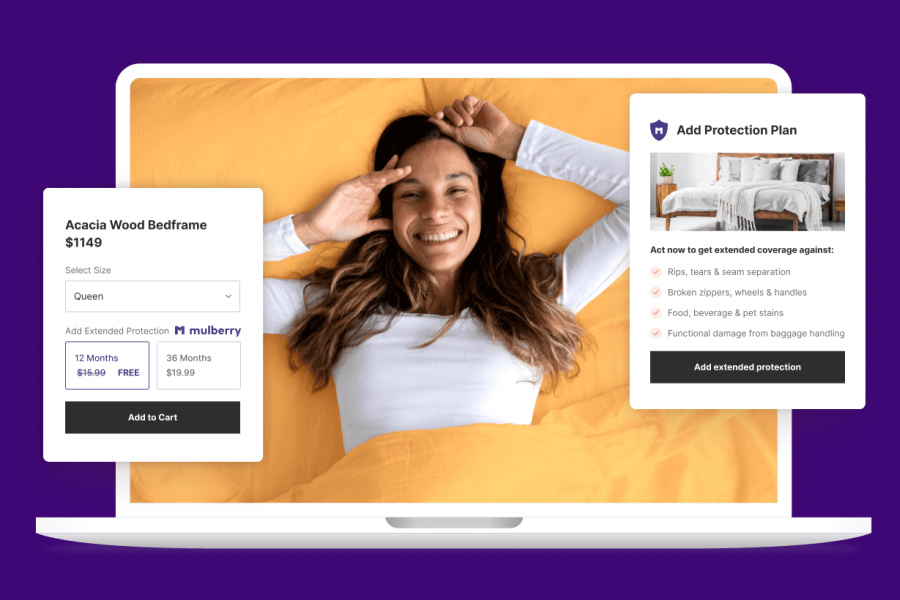

by Cool Mom Team | Tips + Tricks, Helpful Services, Tech CMP-Style

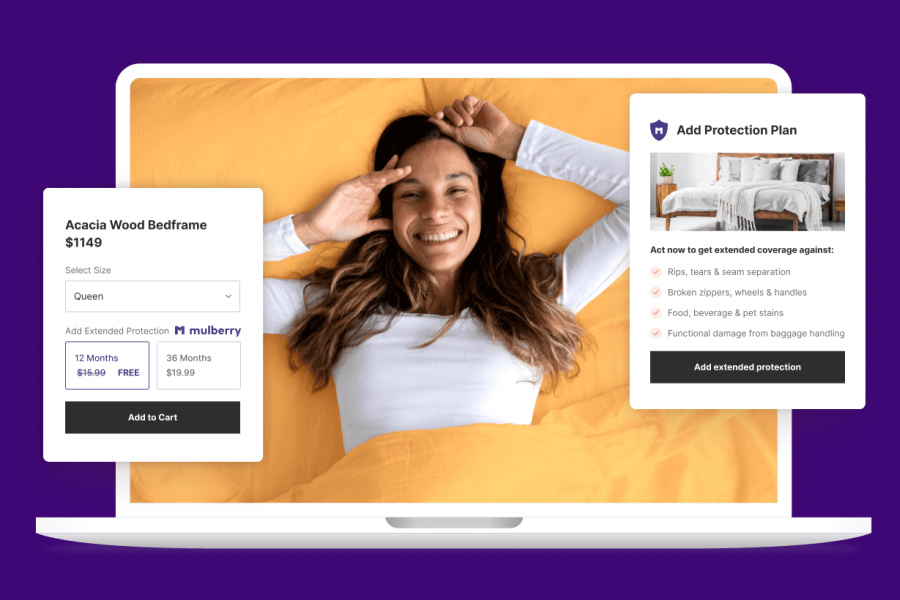

This is a sponsored message for Mulberry ‘Tis the season for holiday shopping, and that also means holiday savings. At least if you’re savvy. That’s where Mulberry comes in. Download the free Mulberry browser extension from Chrome, and for 12 entire...

by Cool Mom Team | Living

This is a sponsored message from Capital One Shopping Capital One Shopping compensates us when you get the Capital One Shopping extension using the links provided These days, we’re all shopping online, and we’re all looking for great prices on...

by Cool Mom Team | Spawned Podcast, Tips + Tricks

We love sharing tips for saving money when it comes to holiday shopping. Maybe because we love saving money ourselves? So this week on the Spawned Parenting Podcast with Kristen and Liz we are hooking you up, big time. We’re rerunning a favorite show that...