We’ve been really pleased to get so much great feedback from you all when we post about financial matters, from budget tips to college savings. As parents, it’s one of our (many, many) jobs to be as financially prepared as possible– not just for all the awesome exciting stuff, but sometimes, for the not-so-great stuff too. Hey, adulting is hard! Which is why every financial expert will tell you to be sure you have an emergency fund, and we couldn’t agree more.

So we’re thrilled to be working with Upromise by Sallie Mae and the new Upromise GoalSaver account, a completely no-fee, no minimum balance savings account which makes it super easy to save for all the aforementioned awesome exciting stuff, like a college education or a new home, and also for the responsible stuff like getting together an emergency fund for your family.

So we’ve put together some helpful tips for you if you’re ready (or not) to start creating and building up an emergency fund: What it is, why need it, and how to make saving for it as stress-free as possible.

Why you need an emergency fund: 13 reasons that may not be what you think

If you’re like us, you may have thought (for good reason) that an emergency fund is for big time emergencies. But that’s not the whole story. It’s really a nest egg of any size that you can manage to help you through unexpected situations that could require more money than you typically have available in a bank account.

In other words, an emergency fund is there to help you maintain your current lifestyle through a major life change without digging deep into savings or dipping into a 401(k) which will cost you a ton in fees and penalties.

So what’s a life change? Well, it can be good or not so good. Like:

1. A sudden illness, accident or other procedure requiring medical care

2. An unexpected job loss

3. An incredible opportunity that happens to require travel. A safari? Academy Awards tickets?

4. A medication change, allergy diagnosis (ugh, shots), and other treatment needs that aren’t covered fully by your insurance

5. A dream job opportunity that could require a pay cut. But you know, dream job!

6. A sudden, unexpected move like our editor Kristen recently had to make when her landlord sold her rental home. No fun.

7. A sudden, unexpected move by your college student from a dorm to an off-campus apartment, for reasons that will one day be more clear.

8. Car problems. Grrrr.

9. A funeral that requires last-minute, expensive travel. (The days of affordable bereavement fares are sadly, long gone.)

10. Your child’s annual class trip that is no longer Washington DC…it’s now London.

11. Dental work, considering dental insurance covers pretty much nothing.

12. The desire to take unpaid time off from work to be home with your kids or to care for another relative.

13. A big ticket item you’ve been coveting forever that recently went on sale, whether it’s a new car, home improvements, or something a little indulgent. Hey, we all define emergency a little differently.

As you can see, there are lots and lots of reasons that you’ll be grateful to have some extra cash on hand in an emergency fund. We bet you can think of even more.

How to start saving for an emergency fund

Building up your emergency fund is less a matter of how to get started, and more a matter of when. And the answer is: right now! Like, yes, this very second. You don’t even need to start with a huge chunk of money, or even a large goal you’re working towards. Simply set aside a small amount that you can afford each week, if only a few dollars, and just do it.

You can even dump your spare change at the end of each day, then each month, transfer the total into that emergency fund. You’ll be surprised how fast it adds up.

(Plus, most parking meters are taking credit cards now instead of quarters. Though we admit we’re still in the habit of hoarding them in the car)

You’re going to want this fund accessible and liquid, so you have access to it without jumping through too many hoops or waiting longer than you have to. There’s always a cookie jar at the top of the kitchen cabinet — which we don’t recommend. And of course a regular savings account is a safe bet, but might not offer a whole lot of benefits. That’s why it’s good to look at options made for this express purpose.

——— About our sponsor ———

Upromise by Sallie Mae is free-to-join service that allows you to save cash back for college through everyday purchases by shopping at more than 850 retail partners and dining at 10,000+ restaurants partners. Their new Upromise GoalSaver account was designed to help families save for all expenses related to education. It’s totally free, and unlike some 529 funds or Education Saving Accounts, there’s no minimum to get started. In fact, it can make you money, with a 0.80 APY and cash bonuses for setting up automatic payments.

![Upromise GoalSaver: Smart no-fee account to save for college, emergency funds, vacations and more [sponsor] Upromise GoalSaver: Smart no-fee account to save for college, emergency funds, vacations and more [sponsor]](https://i57.photobucket.com/albums/g240/lizcoolmompicks/15-cool-mom-picks/upromise-goalsaver_zps45zluk4j.jpg)

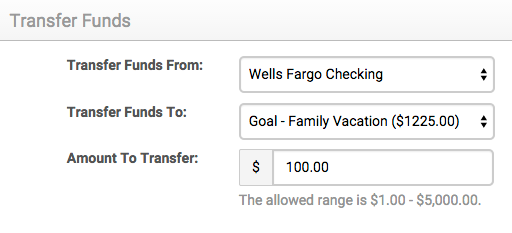

One of the biggest benefits is that GoalSaver allows you to set up and track multiple goals with one single account — college savings, textbooks, housing, family vacation, holiday gifts, even that emergency fund. So when you make a deposit, you can earmark it for a particular goal or a particular child, then even move it around.

In other words, if you find yourself with emergency home repair bills, it’s easy enough to transfer the cash out of the “Buy a Yacht One Day” fund and put it to use right away when you’ve got a Upromise GoalSaver account.

———————————-

Where to get money for your emergency fund:

3 sources in 1 day

We get that when you commit to saving a little more each month, it’s not like you can just hop over to that proverbial money tree some of our parents talked about. And if you’re still paying off debt like credit cards or school loans, it can be hard to rationalize saving money when you’d rather get those bills paid off. Hello, interest.

So, aside from saving your change, which we’ve already mentioned, here are a few quick things you can do to find more money in your budget each month without cutting back heavily on spending. Though of course, you can do that too.

The best part: Set aside one afternoon to make some calls and do a little research, and you can knock off all three of these pretty easily.

1. Get rid of unnecessary bills. This seems really simple, but so often we’re paying for stuff we don’t actually use. Still paying for premium channels when you’re pretty much watching everything on Netflix? What about that gym membership you never use? Or, those magazines and newspapers you keep getting in the mail and don’t read, but save them out of guilt? (We might know a little thing about that.) Take a quick scan of all the money you’re paying out each month and you can probably determine a few expenditures you can get rid of right off the bat.

2. Transfer credit card balances to a no-interest card. If you’re carrying a balance but your credit rating is relatively good, you should be able to find a card that offers an account balance transfer incentive for new cardholders. You may be able to hold off on all interest payments for as long as 12-18 months while you pay down your balance; and in the meanwhile, you can take whatever you were previously spending on interest and put that towards building up your emergency fund. (Just be sure to read the fine print! You generally can’t be late with a single payment, or you’ll be stuck with a really high interest rate.)

3. Consider lowering auto and homeowners insurance premiums. It really only takes a few minutes to get an insurance quote and you might be surprised to find that you’re paying more than you should. Companies are pretty competitive, so it’s worth looking at your current rate and seeing if yours can top it, or if maybe a different company can offer you better terms at a better price.

If all of this is stressing you out, please don’t be stressed!

Really, it’s about doing something small and relatively simple now so you never get to the seriously stressed out phase. There are a lot of thing we all say we’d do over as parents, but one thing you’ll never regret is having an emergency fund.

Thanks to our sponsor Upromise by Sallie Mae and the new Upromise GoalSaver account for making it easy for families to save for everything from college to down payments, and even life’s emergencies.

Photo credits: kenteegardin, MarkMoz12, frankieleon, StockMonkeys.com via compfight cc

Thanks for sharing this. I’m committed to building an emergency fund and this year, I finally got around to living within my means. I got around to delaying gratification. It’s painful but I know it’s vital to achieving my financial goals.