We have shared so much over the years about financial tips for kids, whether it’s getting them a bank account when they’re born, or talking to them about savings and charity. But this past week, I had the joy of attending a FutureSmart event for tweens and young teens on behalf of our sponsor MassMutual, and wow.

I didn’t expect it to be so informative, so moving, or so inspiring.

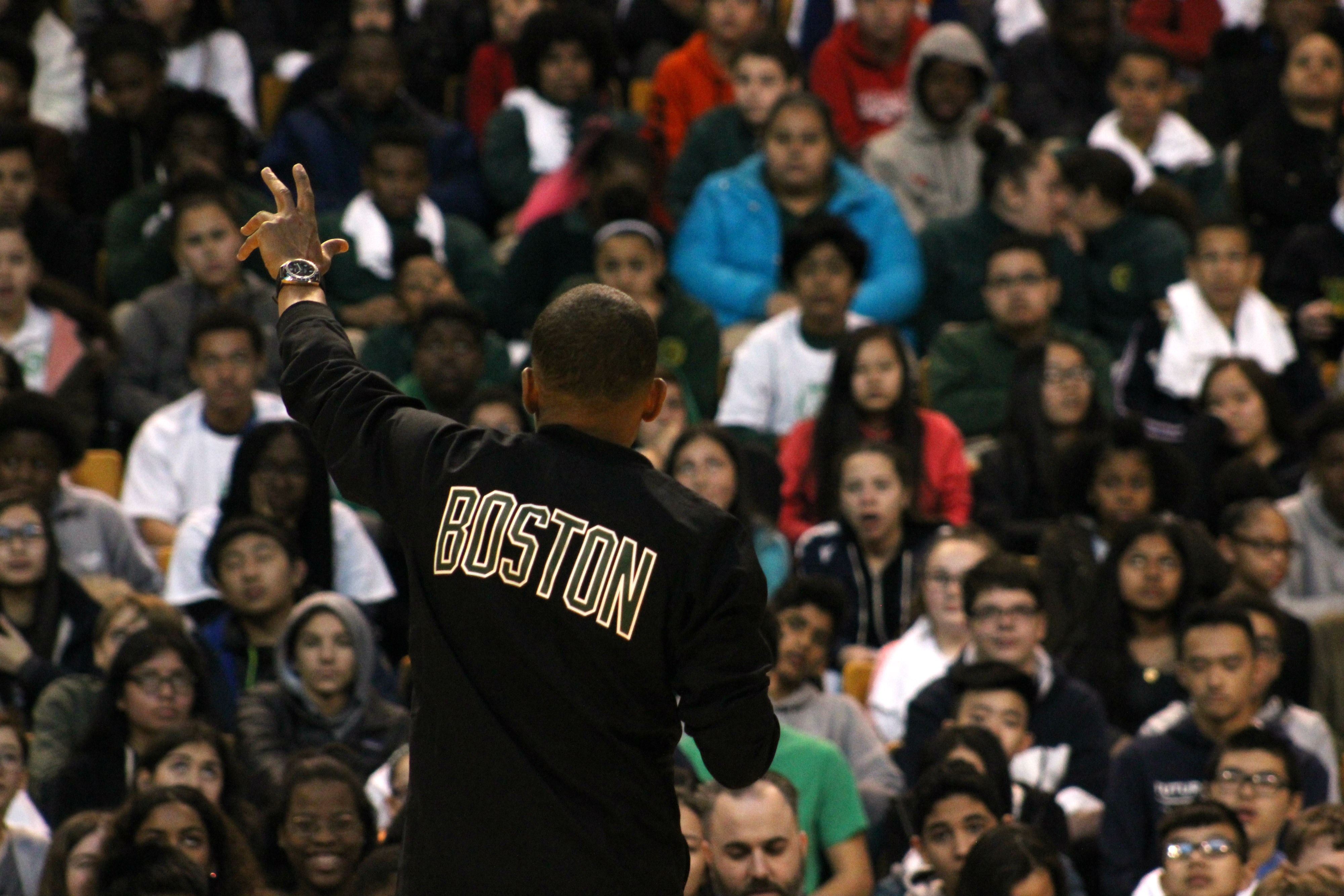

Boston’s TD Garden was packed with a few thousand Boston-area middle schoolers. (Shout-out to the cool kids of Clark Lane and John D. O’Bryant middle schools who I spoke to!) And they got a major financial literacy pep talk from the prolific actor, author, philanthropist, Harvard Law grad, cancer survivor, and now new father, Hill Harper.

Truly an impressive man. And frankly, I learned a lot from him too.

It really was moving to me, since I really believe in order to have economic justice and more wealth equality in this country, we need all kids to understand some basics about money. So really, what the MassMutual Foundation is doing is important stuff; not just for our own kids, but for our country’s future as a whole, and I’m so proud to support what they’re doing.

A rising tide lifts all boats, right?

With that, here are 6 things kids Hill wants to make sure that kids know about money, to help them be savvier about spending and saving, and to give them more opportunities in life to reach their goals.

1.Know why money is important

Learning about money is the first step to getting kids to be smart about it. They don’t have to check your Stocks app each morning or study macroeconomics in sixth grade, but they can start by understanding why money matters.

The way Hill broke it down: When you have dreams, they can be facilitated through money. And when we are rewarded for tasks or for performing exceptionally in life, money is generally that compensation. Therefore, having money really does open up the ability to fulfil dreams.

I really like that he made a point to say that money is not more important than friends, family or love. (Nice new take on “money doesn’t buy happiness.”) However it does provide more life choices; and that means your smart money decisions can help you you make the most out of those things that do matter — like friends, family, and love.

The other thing I like: This quote from Hill.

Like I said, he was really inspiring!

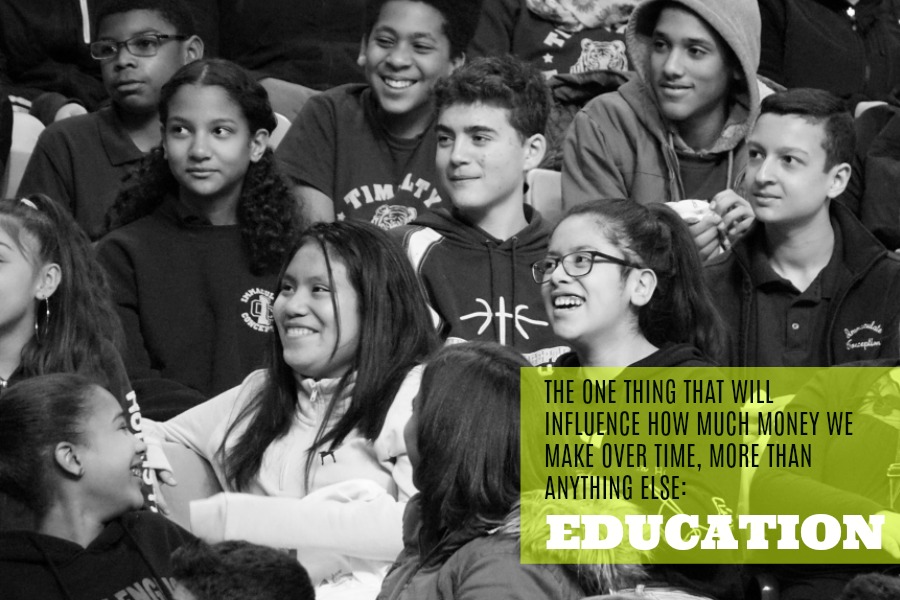

2. Education matters. A lot.

I think it was important that Hill noted that the one single thing that will influence how much money we earn over time, more than anything else, is education.

While we parents often say we want our kids to learn for the sake of learning (and I do!) we can’t pretend that an education doesn’t matter in the scheme of things, especially when it comes to success in life — whatever that looks like to you.

So the grades kids get now, the mentors they adopt along the way, the passions they pursue — it all matters. And for kids who aren’t so big on school, they should know that these are the things that will lead to more educational opportunities, which can in turn lead to more financial opportunities.

3. Spend smart, not dumb.

Hill talked about smart purchases versus dumb purchases (he pulls no punches!) and quizzed kids on the difference.

Smart purchases are things like healthy food, a class you really want to take, clothing you need, your rent or mortgage.

Dumb purchases: A tenth pair of basketball shoes, potato chips and sodas at lunch, flashy jewelry (they are middle schoolers after all), and later in life, the interest paid on payday loans or credit card debt. Because spending only the money you have and not relying on advances or credit is an essential part of good money management.

Also important: Use cash instead of cards. There’s so much research that indicates people spend far less money — and spend it more responsibly — when they’re seeing actual dollar bills leave their wallets.

4. Set goals and build a blueprint

Most parents walk around without a blueprint, and don’t have a plan for the future. It’s not a judgment; there are all kinds of reasons for this. But Hill’s goal is to make sure more kids grow up with a sense of where they want to get, then chart a course to get there.

Kids in the FutureSmart program get an actual blueprint worksheet, but it’s easy for you to make your own. In it, you fill out:

1. Your personal values (What matters to you in life? Like having a family, helping others/giving back, traveling, or owning your own car.)

2. Career goals (Scientist, NBA player, actor, artist, veterinarian, photographer, you name it — write down what you want to be, and what kind of education you need to get there.)

3. Education goals (Based on your career goals, what kind of school will you need to attend? For how long?)

4. Paying for education (Will family help? Will you need grants, scholarships, loans, or work-study?)

5. Ways to prepare (What will you need? Good grades? A summer internship? Job experience? Volunteer experience? A lot of savings? A car?)

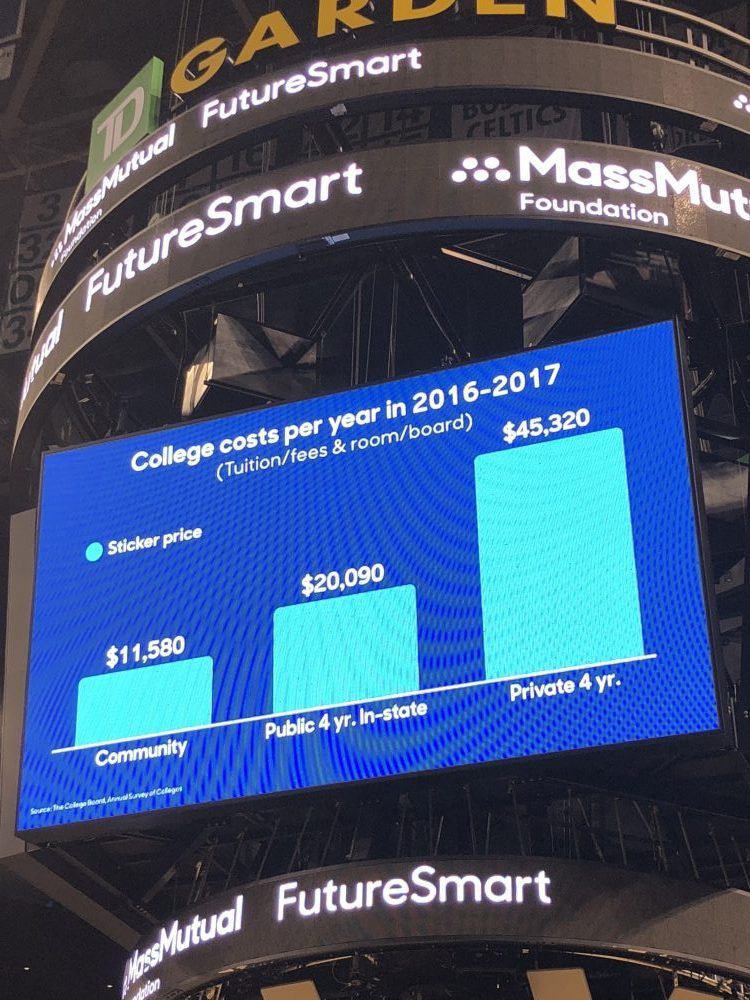

This chart was a huge wake-up call for the kids in the arena!

This chart was a huge wake-up call for the kids in the arena!

When you’re thinking about higher education, consider this: For the 2016-17 school year, including room and board, costs averages about $11,580 for community college, $20, 090 for a public state school, and $45,320 (holy….) for private four-year colleges. That’s just the average! And it’s not going down any time soon.

5. Pay yourself first.

More than anything else, Hill wants kids to know that savings is the single most important piece of any financial plan. Having savings can be transformative in your own life, the life of your family, and even your community.

To get there, Hill’s advice is the same my dad always told me: “Pay yourself first.” I always loved that. He suggests 5%, meaning if you get $20 a week in allowance, put aside $1 each week minimum toward savings and by the end of the year you’ll find you’ve saved $52.

(Of course you can save more, too.)

While piggy banks and jars are okay for starters, it’s far better to open a savings account so your money can earn interest.

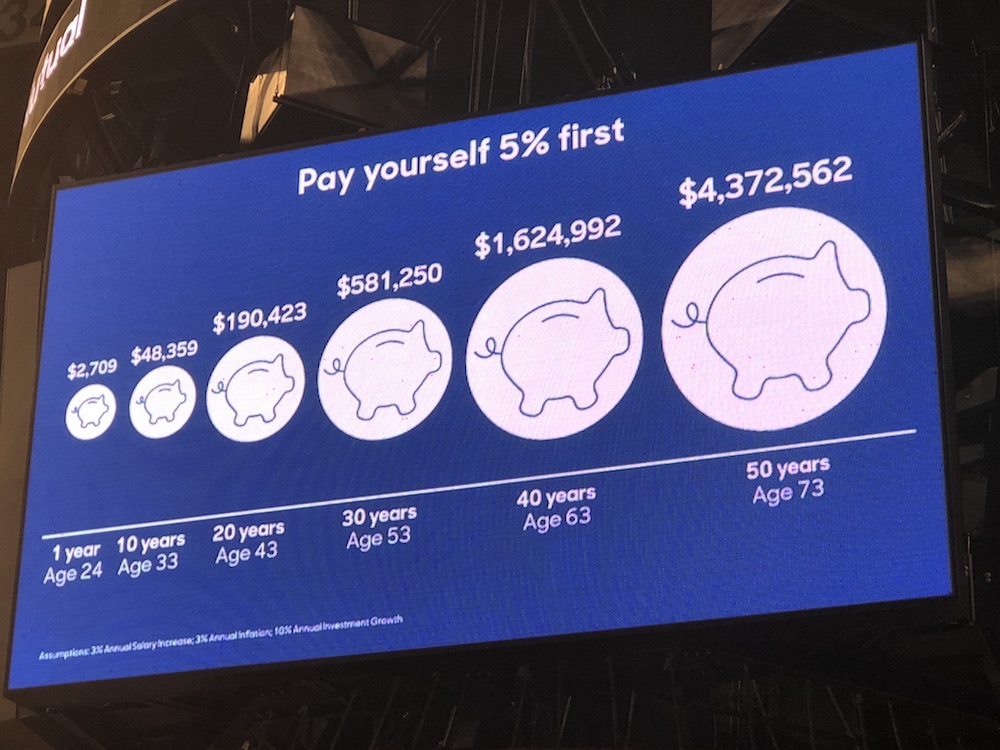

By the way, I loved the faces of the kids in the arena when Hill revealed this chart, that really brought this tip to life.

It shows just how much $2700 can become over time if you keep adding 5% of your salary each year to your savings. (The amounts shown account for inflation, 3% annual salary increases, and 10% investment growth.)

6. Talk with your family

If kids keep channels of communication open with parents about your long-term goals, we can help you work toward them. Hey, that’s our job!

And with that, I’ll leave you with the requisite selfie I took with Hill Harper, my Brooklyn neighbor and an all-around amazing guy.

This article was sponsored by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001. All opinions are those of the author, from tips picked up attending the FutureSmart Boston event